how to check unemployment tax refund amount

Once you submit your application we will verify your eligibility and wage information to determine your weekly benefit amount. Social Security Number 9 numbers no dashes.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Up to 3 months.

. You may be able to use Form W-4V to voluntarily have federal income taxes withheld from your payments. The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week. Unemployment benefits are generally treated as taxable income according to the IRS.

It might be a couple of months before you get it. How Long Do You Have To Work To Get Unemployment In Tn. Visit IRSgov and log in to your account.

Refund amount claimed on your 2021 California tax return. For more information about your refund you may call 317- 232-2240 Monday through Friday from 8 am. Review and change your withholding status by calling Tele-Serv and selecting Option 2 then Option 5.

The new employer rate for 2021 increased to 4025 up from 3125 for 2020. Some tax returns need extra review for accuracy completeness and to protect taxpayers from fraud and identity theft. In Box 4 you will see the amount of federal income tax that was withheld.

Up to 3 weeks. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. IRS sending unemployment tax refund checks For most states you will receive Form 1099-G in the mail from your state unemployment office.

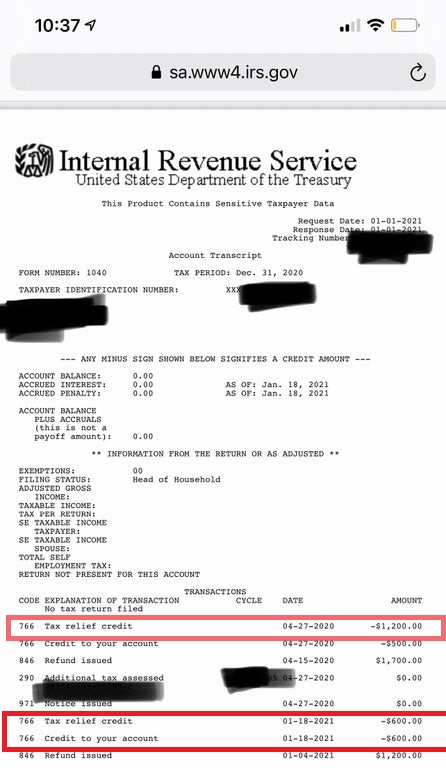

This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. 4 weeks after you mailed your return. This is the fourth round of refunds related to the unemployment compensation exclusion provision.

In Box 1 you will see the total amount of unemployment benefits you received. This is available under View Tax Records then click the Get Transcript button and choose the. Your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars which you can find on your tax return.

The easiest way to do this is by figuring out your taxable income by not adding the unemployment compensation exclusion youre eligible for and then tax liability. Will display the status of your refund usually on the most recent tax year refund we have on file for you. In other words Form 1040 line 11 minus Schedule 1 line 7 is less than 150000.

The 2021 New York state unemployment insurance tax rates range from 2025 to 9826 up from 0525 to 7825 for 2020. ZIP Code 5 numbers only. Heres how to check your tax transcript online.

How Much Is Unemployment Tax In Ny. Once logged in to your account youll see the Account Home page. If we have bank account information for you on file well issue your refund by direct deposit to that bank account.

However check with your state to see if it has its own form. 24 hours after e-filing. 540 2EZ line 32.

Current refund estimates are indicating that for single taxpayers who qualify for the 10200 tax break and are. If youre expecting a refund on unemployment income but you dont receive one contact the IRS and inquire about it. Visit IRSgov and log in to your account.

Numbers in your mailing address. Stimulus 1 stimulus 2. Check Your 2021 Refund Status.

If so use the state form instead. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt. If none leave blank.

You can call the agency at 800-829-1040 or you can use the IRSs Wheres My Refund tool to check up on the status of your refund. If you havent opened an account with the IRS this will take some time as youll have to take multiple. If none leave blank.

The IRS now has to pay you more interest on any money it owes you. Your tax refund comes from your overpayment of taxes in. Click View Tax Records.

If all four of those conditions are true The IRS will recalculate your tax return and send you the refund. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued. Check My Refund Status.

Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. Your Adjusted Gross Income AGI not including unemployment is less than 150000. Keep in mind that if you filed a paper return your refund may be delayed.

Contact your state unemployment office to have federal income taxes withheld from your unemployment benefits. Find out how you can obtain your 1099-G. If you havent opened an account with the IRS this will take some time as youll have to take multiple steps to confirm your identity.

As of July 1 the interest rate for overpayment rose from 4 to 5. If your account is no longer valid or is closed the bank will return your refund to the IRS and a check will be mailed to the address we have on file for you. Another way is to check your tax transcript if you have an online account with the IRS.

Refund Amount Whole dollars no special characters. If your mailing address is 1234 Main Street the numbers are 1234. This is not the amount of the refund taxpayers will receive.

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion. How To Check The Status Of The Payment One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

For more information refer to How Unemployment Insurance Benefits Are. Your exact refund amount. Numbers in Mailing Address Up to 6 numbers.

For some there will be no change. How long it normally takes to receive a refund. Lastly compare it with your total tax payments and see how much is your total tax refund.

Another way is to check your tax transcript if you have an online account with the IRS. Review and change your withholding status by logging onto Unemployment Benefits Services and selecting IRS Tax Information from the Quick Links menu on the My Home page. Online Account allows you to securely access more information about your individual account.

Heres how to check your tax transcript online. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt.

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Unemployment Tax Refund Update What Is Irs Treas 310 King5 Com

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Millions Of Americans Won T See Their Tax Refunds For Months Time

Interesting Update On The Unemployment Refund R Irs

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa

Irs Starts Sending Tax Refunds To Those Who Overpaid On Unemployment Benefits Cbs News

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Sending Out Another 1 5 Million Tax Refunds To People Who Overpaid On Unemployment Benefits Cbs News

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My 2022 Refund And What Does It Mean When Transcript Says N A Aving To Invest

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com